Outside the Box: Why China is cutting the cord on traditional TV ads (the future is Smart and it’s already here)

The Provocateur – Sonderserie „OUTSIDE THE BOX“: Wavemaker Experten analysieren zum Nachdenken anregende Themen und teilen mit uns offen ihre Meinung und Gedanken.

In China, Smart TV advertising is the biggest growth area in digital media. Brands are flocking to its new formats, super-targeting abilities and creative freedom. Sachin Gupta, our China Head of Investment, explains the excitement and gives us a glimpse of the future.

Chinese viewers spend an average of 96 minutes a day watching online TV, making us the 6th biggest market by time spent globally. Brands are following the audience and shifting budget from linear television to addressable formats on Smart TVs and other over-the-top (OTT) devices.

Chinese viewers spend an average of 96 minutes a day watching online TV, making us the 6th biggest market by time spent globally. Brands are following the audience and shifting budget from linear television to addressable formats on Smart TVs and other over-the-top (OTT) devices.

Our clients are investing because they can see its tremendous potential. The numbers tell their own story. A joint study from our parent company GroupM and AVC, specialists in big data analysis for Smart TV, reported an increase in ad spend from RMB 2.6 billion ($0.4 billion) in 2017 to RMB 12 billion ($1.9 billion) in 2020– and forecast to double in the next two years.

So what’s the attraction? Apart from being an emerging medium in the digital era, Smart TV advertising has the unique advantage of being an interactive space AND a connector – driving discovery and viewing of further content within the OTT environment. It is fast becoming

a popular marketing channel on top of the traditional digital space dominated by China’s online giants Baidu, Alibaba and Tencent (BAT).

Unlike traditional and online television, Smart TV is an emerging and exciting world of its own, capable of engaging audiences with new approaches and delivering better results. In China, we’ve used its exciting functionality to deliver a wide variety of campaigns for clients. Here are a few examples:

Mercedes-Benz AMG

Using the immersive capabilities of Smart TV, this multi-screen ad treatment highlights the racing heritage of the brand, with high-octane track shots and engine sounds moving through an engaging mini-movie format. A lot of excitement for a family car! Plus clickable menu options and search functionality within the ad. The campaign engaged a huge audience, delivering over 14 million impressions.

Tiffany & Co

Fittingly for the reinvention of the heritage jeweller’s classic T collection, the Smart TV campaign for Tiffany T1 has every cutting edge trick, from a choice of character-led ads, to voice interaction and click-to-discover more and buy on the Tiffany & Co site.

Darlie

This super-cute ad for Darlie’s new baking soda toothpaste is a great example of ecommerce in a Smart TV ad – the on-screen search bar auto-fills with the new product name, and the ad wraps up with a menu of product options to explore instantly.

DENZA

A joint venture between Mercedes-Benz and Chinese Smart Car brand BYD, DENZA, for this launch we partnered with tech giant MI, using their vast ecosystem of tech connected devices to create an incredibly joined-up customer journey – starting with Smart TV. The results were a testament to both the partnership and the power of Smart TV, with a 148% increase in brand preference and an amazing 1855% increase in test-drive consideration.

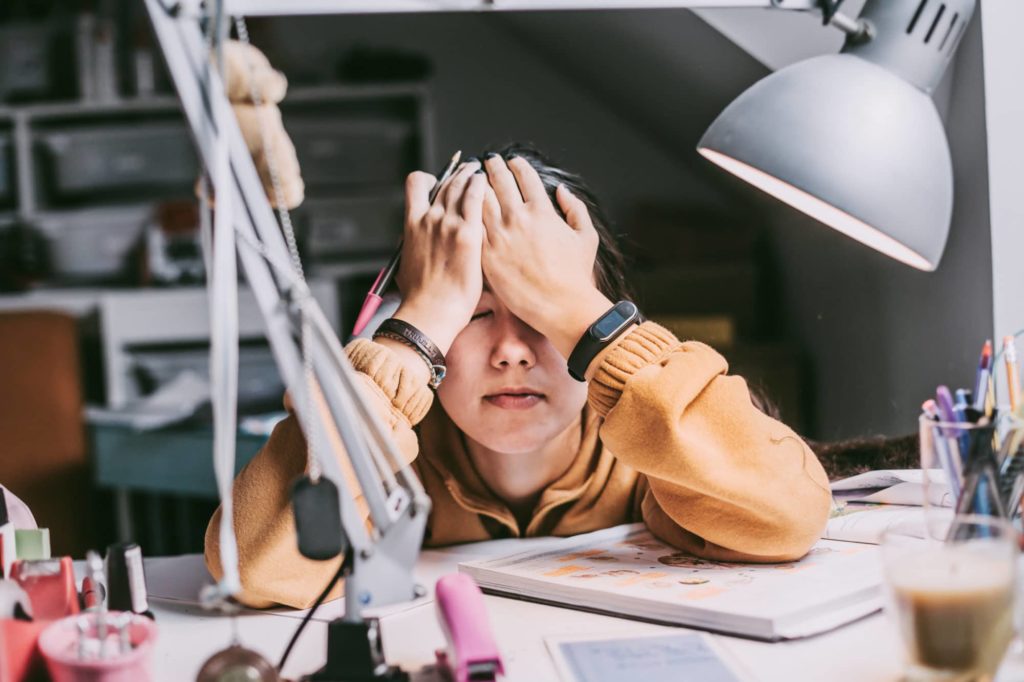

But there’s a challenge…

Before the internet, streaming devices and big data were around, we used to have a very mature tracking system for traditional TV. But if you’re still using immature performance-tracking data systems that lack benchmarks, and are not effective at analysing the data, then the new world of television can be intimidating, making good marketing decisions a real challenge.

We are facing a new set of data providers for the OTT world, with methodologies that need

to be verified and improved. As we know, all methodologies and data usage evolve through time, and there needs to be constant test-and-learn with continuous data collection and an evolution of best practice. From our experience in China, we need to actively demonstrate the huge potential of Smart TV advertising to clients, so they understand the importance of committing budget to help us all master the best way of building brand value from this fast-evolving touchpoint.

And exciting opportunities:

A bigger and better role for the ‘big screen’

A bigger and better role for the ‘big screen’

Smart TVs have given birth to many new advertising options (formats, players, technologies) which are expanding the role of TV. This is giving new life to an old channel and means brands can explore and use it in more impactful and immersive ways.

As formats evolve from TVC, brands have a chance to provide consumers with more creative digital ads inspired by tech on the big, beautiful screens of Smart TV, with their attention-grabbing advantages over mobile phones and tablets.

The role of advertising on TV is expanding beyond classic reach to in-depth storytelling, embedded in the content – with the all-important potential of creating a closed loop by connecting to ecommerce.

Smarter spending through targeting

With technology advances driven by tech giants and hardware manufacturers, Smart TV means we can continue to improve our targeting to specific people and families. By being in the right place, in the right context, with the right ad content.

In China the targeting capabilities of Smart TV ads give us a unique opportunity. China divides its cities into four tiers, each reflecting population, wealth, infrastructure and business opportunity among other factors. The cost of traditional nationwide TV ads continues to be very high, but Smart TV gives us an opportunity to approach lower-tier cities in China, using a much more targeted approach that comes at a controlled cost. The penetration of Smart TV in lower-tier cities continues to increase, and we are encouraging our clients to pay more attention to this growth. According to GroupM, approximately 20% of consumers in Tier 3-4 cities often use OTT devices, including Smart TVs, to access the internet. The percentage of viewers watching video-on-demand on these devices has increased from 27% in 2017 to 54% in 2020.

New approaches, bigger wins

With data partners, martech providers and hardware companies all eager to improve their data capabilities, it’s likely there will be more data available to better target consumers with more relevant (and creative) content. These new data sources will help enrich the database for different usage.

Learning from both traditional and digital devices, Smart TV advertising lets us create, adapt and try different approaches. Especially interesting is the application of ‘mobile device’ logic, where we are testing the potential of activity that’s been super-successful on hand-held screens, including live-streaming, connecting to ecommerce directly and even small games.

What’s next for brands?

The new world of Smart TV advertising may be moving fastest in China, but it’s on the move in all markets as consumers transform how and where they watch TV and video. My advice for brands who want to get ahead is:

- Diversify your investment by considering Smart TV advertising as a must-have part of your media mix (not an optional extra or an incremental play).

- Right now OTT providers are open to new practices as they work hard to improve their

data capabilities, so embrace this open mindset and partner with them to test-and-learn.

It’s a sound investment. - Take the opportunity to immerse your brand in your consumers’ lifestyle. The targeting capabilities of Smart TV ads make it possible to better-identify audiences and the special moments and scenarios where your brand is a great fit.

- The best advice I can give you is to think strategically about OTT beyond a ‘touchpoint’. Not only is it an ecosystem all of its own in which you can connect to all channels and close a sale), it has a world of possibilities that other, cluttered digital touchpoints do not – innovative formats, a great environment to test more advanced data solutions, plus fantastic partnership potential, like the DENZA and MI example.

Despite all its power and potential, many brands continue to apply the experiences of traditional TV to Smart TVs, wondering why old advertising logic isn’t paying off in a new space. As the only way (for now) to connect traditional TV to digital, Smart TV is a truly unique platform to fill with your own imagination, and it will reward the brands that dream big and embrace it.