Consumers have new and differing views on value; smart brands are adapting to take advantage.

As economic turbulence looks set to stay for the foreseeable future in many countries, consumers are finding new ways to manage their limited spending power. Savvy habits picked up during the pandemic and tough choices necessitated by ongoing inflation have given birth to a new attitude to value. This presents a challenge and an opportunity for brands open to changing their marketing tactics during 2023.

Research by our US team confirms that consumers are more optimistic and spending again, albeit cautiously. After hitting financial confidence rock bottom in June 2022, 39% of US shoppers expected to be better off, 42% about the same and 19% worse off in the following months. This was borne out with Black Friday spending up 14% and Cyber Monday up 11%.

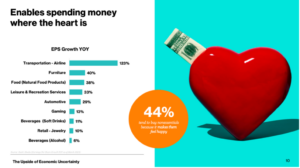

So far, so we’ve-been-here-before, after the recessions in 2001 and 2008. The difference in this economic cycle is that brands are dealing with a changed consumer. Shrinking budgets has not only taught US consumers what products and experiences they really value – through tough spending choices and the reappraisal of our lifestyles during the pandemic – it’s also taught them how to root out the best value brands for these priority buys. Non-essentials like travel, leisure activities and good food figure high on this list as people save hard and make sacrifices for the things that bring them happiness in tough times.

From the moment steep inflation kicked in at the end of 2020, consumers cut down and traded down in order to fund these priorities; 75% started buying brands other than their favourites. And a staggering 81% of shoppers now research their online buys compared to 23% in 2008.

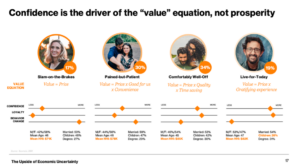

But the most interesting thing our research reveals about this changed consumer is that their new attitude to value is not related to their wealth. For marketers this means prosperity is no longer a reliable guide to purchasing patterns. Instead, purchasing patterns are predominantly based on a value equation driven by consumers’ financial confidence, falling into the four groups below.

Our research deck contains an in-depth profile of each group, but in short this new attitude to, and search for, value (in different forms) drives consumer selectiveness and loyalty more than ever. It should change how brands target their consumer base.

We’re working with our clients to act on the opportunity this change presents (not to mention avoiding the risk of marketing-as-usual). Our belief is that this is the moment for a renewed focus on increasing the topline by winning new consumers, rather than the narrow (if understandable) previous focus on the bottom line.

Across all groups, on one hand we are seeing the release of pent-up demand coupled with reduced loyalty and an increased openness to switching. This is a real and right-now opportunity to win new customers. But to do this means getting out of the squeezed mainstream or mid-segment, which has become less sustainable and profitable in many categories.

At the same time, other consumers are maintaining their spend while staying loyal but more selective. When these shoppers stand in front of the array of choices on the offline or online shelf, Byron Sharp’s theory about winning through mental availability is more important than ever before. In CPG right now, we see that the second-most common reason for switching is not having the brand top of mind. This signals a clear need for brands to keep a close eye on their existing consumers.

There’s a swathe of smart shoppers up for grabs in next six months and beyond, for brands willing to adapt their growth plans to satisfy the new attitude to value. This means a shift in marcom and media planning strategies; for our recommendations and the full research please get in touch. I’d be delighted to share our findings and answer any questions.